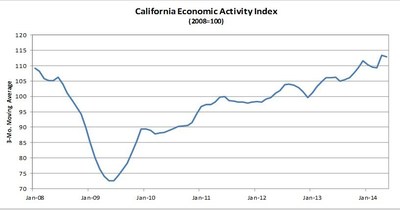

DALLAS, July 29, 2014 /PRNewswire/ -- Comerica Bank's California Economic Activity Index eased in May, declining 0.4 percentage points to a level of 112.9. May's reading is 40 points, or 56 percent, above the index cyclical low of 72.6. The index averaged 106 points for all of 2013, five points above the average for all of 2012. April's index reading was revised up to 113.3.

"Our California Economic Activity Index for May gave back just a little of the solid gain that we saw in April. State labor market conditions continue to improve. In May, California's payroll employment total of 15,448,600 eclipsed the pre-recession high from August 2007. Also, residential real estate conditions are improving across the state," said Robert Dye, Chief Economist at Comerica Bank. "However, we are seeing some softs spots in the data stream. Notably, state exports are subdued as are sales tax collections. Overall, we expect the California economy to continue to grow moderately through the second half of this year and into 2015."

The California Economic Activity Index consists of eight variables, as follows: nonfarm payrolls, exports, sales tax revenues, hotel occupancy rates, continuing claims for unemployment insurance, building permits, Baker Hughes rotary rig count and the Silicon Valley 150 Index (SV150). All data are seasonally adjusted, as necessary, and indexed to a base year of 2008. Nominal values have been converted to constant dollar values. Index levels are expressed in terms of three-month moving averages.

Comerica Bank, with 104 banking centers in the key California markets of San Francisco and the East Bay, San Jose, Los Angeles, Orange County, San Diego, Fresno, Sacramento, Santa Cruz/Monterey, and the Inland Empire, is a subsidiary of Comerica Incorporated (NYSE: CMA). Comerica is a financial services company headquartered in Dallas, Texas, and strategically aligned into three major business segments: the Business Bank, the Retail Bank, and Wealth Management. Comerica focuses on relationships and helping businesses and people be successful. To find Comerica on Facebook, please visit www.facebook.com/ComericaCares.

To subscribe to our publications or for questions, contact us at ComericaEcon@comerica.com. Archives are available at http://www.comerica.com/economics. Follow us on Twitter: @Comerica_Econ.

Photo - http://photos.prnewswire.com/prnh/20140728/130675

Logo - http://photos.prnewswire.com/prnh/20010807/CMALOGO

SOURCE Comerica Bank