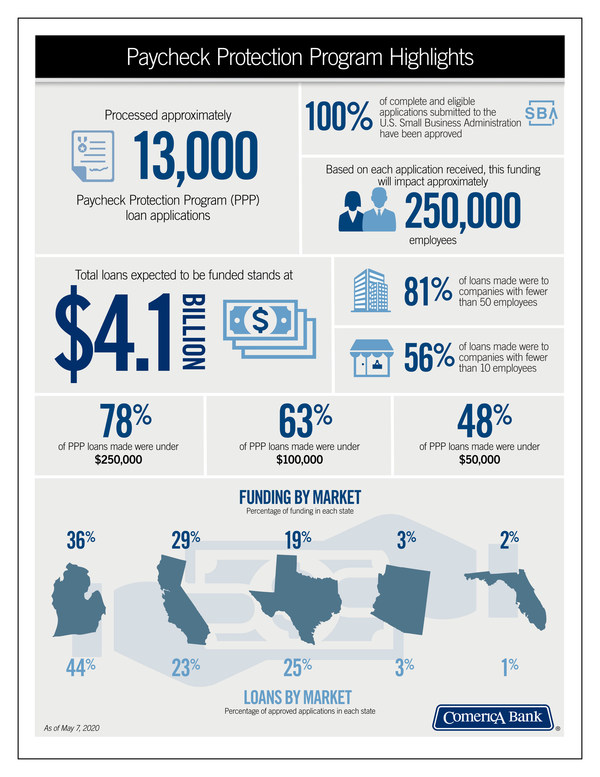

DALLAS, May 7, 2020 /PRNewswire/ -- Comerica Bank announces today that it has processed and submitted approximately 13,000 Paycheck Protection Program (PPP) loan applications, all of which have been approved by the U.S. Small Business Administration (SBA). Currently, the total loans expected to be funded stands at $4.1 billion, with 63 percent of loans being less than $100,000 and 56 percent of loans going to companies with fewer than 10 employees. Based on the applications received, this funding will impact approximately 250,000 employees. Comerica is continuing to take applications from existing customers as of Feb. 15, 2020. Visit comerica.com for additional information.

"I am pleased to announce that thus far we have received SBA approval for each of the complete and eligible applications submitted through Comerica," said Curt Farmer, Chairman and CEO of Comerica Incorporated and Comerica Bank. "We are proud to continue serving our customers by processing these critical loans, helping small businesses cover daily expenses and keep workers on their payroll. Comerica will continue to accept and submit applications in all of our markets until the PPP funds are exhausted."

More than 1,000 Comerica colleagues are supporting the PPP project with the mission of serving our customers as they focus on keeping their workforce intact.

Additional $4 Million Community Commitment

Comerica is also proud to announce another $4 million investment into the communities it serves via contributions to Community Development Financial Institutions (CDFIs) and other nonprofits that support micro-sized businesses, as well as community programs supporting those impacted by COVID-19. Comerica and the Comerica Charitable Foundation announced an initial $4 million community investment on March 24.

"With this additional $4 million, Comerica and the Comerica Charitable Foundation have now committed $8 million to COVID-19 relief efforts. It is more important than ever that we support our communities and local businesses through the nonprofit agencies that are providing critical products and services during these difficult times," said Farmer.

Enhanced Income Payment Program & COVID-19 Customer Relief

Regarding the Enhanced Income Payment (EIP) program (or stimulus payment), Comerica waived its customers' overdraft balances to ensure that they received the full amount of their direct deposit/check from the IRS and U.S. Department of the Treasury. This means if a customer's account showed a negative balance prior to the arrival of their stimulus payment, Comerica forgave the overdrawn amount, so the customer received their payment in full from the government. Comerica will not attempt to collect the forgiven overdraft amount at any time in the future.

"Comerica is a relationship bank and we are here to do right by our customers just as we have for more than 170 years," added Farmer.

Comerica continues to serve its customers by discussing various loan payment deferral and fee waiver options for those who have been impacted by COVID-19. And, for our retail customers experiencing financial difficulty as a result of COVID-19, we are asking that they contact us to discuss fee and penalty waivers, loan deferrals and other considerations that best meet their circumstances. Comerica customers can call (888) 444-9876 to discuss their situations.

Comerica Incorporated (NYSE: CMA) is a financial services company headquartered in Dallas, Texas, and strategically aligned by three business segments: The Business Bank, The Retail Bank, and Wealth Management. Comerica focuses on relationships, and helping people and businesses be successful. In addition to Texas, Comerica Bank locations can be found in Arizona, California, Florida and Michigan, with select businesses operating in several other states, as well as in Canada and Mexico. Comerica reported total assets of $76.3 billion at March 31, 2020 and celebrated its 170th anniversary last year.

SOURCE Comerica Bank